ESCROW SYSTEMS

C-TRADE SUITE

DISCOVER OUR

Trading & Settlement solutions

C-TRADE is a comprehensive suite of mobile and internet-based products designed to automate the end-to-end processes of the entire capital markets from securities trading, clearing and settlement. The innovation was developed to harness and promote participation of every type of investor from the smallest retail to the largest institutions in financial and capital markets.

The C-TRADE suite comprises of the following;

C-TRADE match is an Automated Trading System (ATS) which matches the orders posted through the various routing channels. It eliminates the laborious process of trading manually and introduces an era of electronic trading which enhances efficiency. Trading data is made available to participants as market data. The ATS transmits trade data for settlement to the respective depository system in real time using standardised protocols.

The C-TRADE depository is instrumental in the clearing and settlement of trades through the maintenance of the investor accounts and the electronic securities. The system contains modules which are laced together to provide robust, wide reaching and interoperable functionalities that are all encompassing with respect to every market players’ activity. These compact and responsive functionalities have been put together into a robust architecture that ensures all market systems and participants are efficiently serviced by the system.

C-TRADE surveillance is a state-of-the-art software, designed to give a bird’s eye view of all the market activities as follows;

- A consolidated view of market information on a per instrument basis across multiple venues.

- Overlays of user- selected “related securities” and market data in a single, intuitive snapshot.

- A user-friendly solution that enables organisations to improve their efficiency in monitoring trading platforms.

- Combines real-time and historical data to detect market abuse, manipulation, money laundering, rogue trading and rogue algorithms across asset classes and markets

- Can be scaled to meet the most demanding big data volumes.

C-TRADE Order Management System is a web-based solution designed to enable institutional investors to carry out direct trading and portfolio management. It is a web-based solution which automates the interaction between institutions, the securities dealers and the market. It facilitates real- time transactions and turn-around trading i.e. an institution can trade using the expected future securities or funds pending settlement date.

The C-TRADE broker office (BO) automates all the processes done by Securities Dealers, from client and custodian interfacing for account creation and management, exchange and depository interfacing for order posting and order management, to the generation of financial statements (Accounting). The System can seamlessly integrate with multiple Automated Trading Systems and Securities Depository Systems within the market.

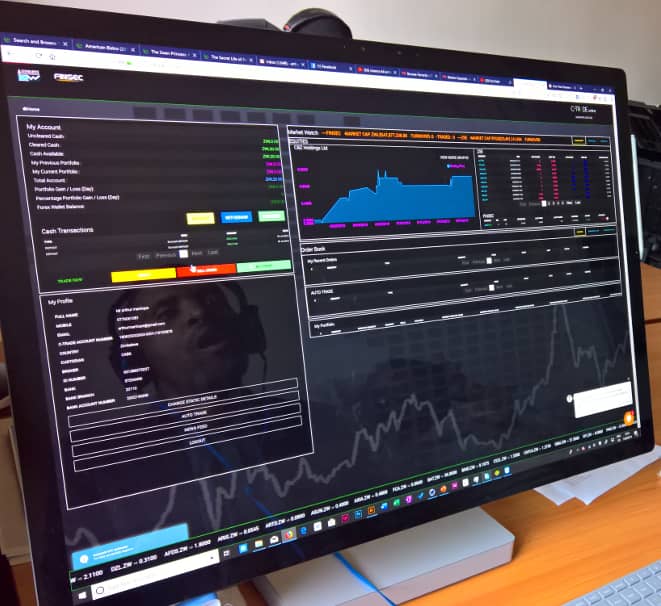

C-TRADE online is a web portal designed to enable retail investors to carry out direct trading and portfolio management. It is a web-based solution which automates the interaction of an individual with the securities dealers. It offers a wide range of online and mobile payment options for the funding buy orders. It facilitates real time transactions and turnaround trading i.e. an individual can trade using the expected future securities or funds pending settlement date.

This flavour of C-TRADE is basically a USSD endpoint which comprises the full customer journeys covering functionalities from registration, primary market and secondary market functions up to account and portfolio maintenance. This end will be integrated to a Mobile Network Operator’s USSD gateway and subscribers will access the application through a reserved short code.

This comprises of simple and secure Android and iOS trading applications tailored for both smartphones and tablets devices one can now enjoy simple, convenient and hassle-free trading of securities.